Key Data

ECONOMIC CONTRIBUTION

In 2018, the film and audiovisual sector of Europe was worth €121.7 billion, accounting for approximately 22% of the industry globally.

This makes Europe the 3rd largest film and audiovisual sector in the world. The film and audiovisual industry is worth around €540 billion in turnover and is dominated by three players:

- North America: representing 43.6% of the global market, with €238.b billion

- Asia-Pacific: 25%, with €135.5 billion

- Europe: 22.8%, with €121.7 billion

Previous to the tribulations and restrictions the COVID-19 crisis brought upon our daily lives, the AV sector has held firm.

The AV sector is one of Europe’s most valuable cultural and economic assets.

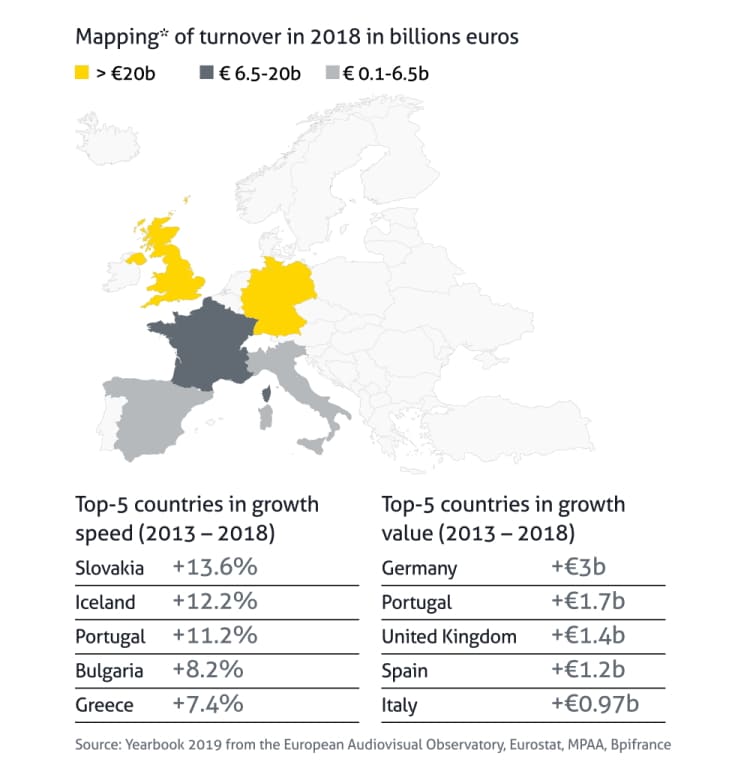

The most dynamic countries in terms of growth were Slovakia (+13.6%), Iceland (+12.2%) and Portugal (+11.2%) between 2013 and 2018.

In terms of value, Germany (+ €3b), Portugal (+ €1.7b) and the UK (+ €1.4b) significantly contribute to overall AV growth.

Germany (€23.5b), France (€16b) and the UK (€23.5b) make up 51% of the total turnover in the European AV sector. The size of the market is important for the film and audiovisual sector: the two main factors which can be attributed to its economic growth, are its ability to leverage massive investments as well as the capacity to market content to large domestic audiences.

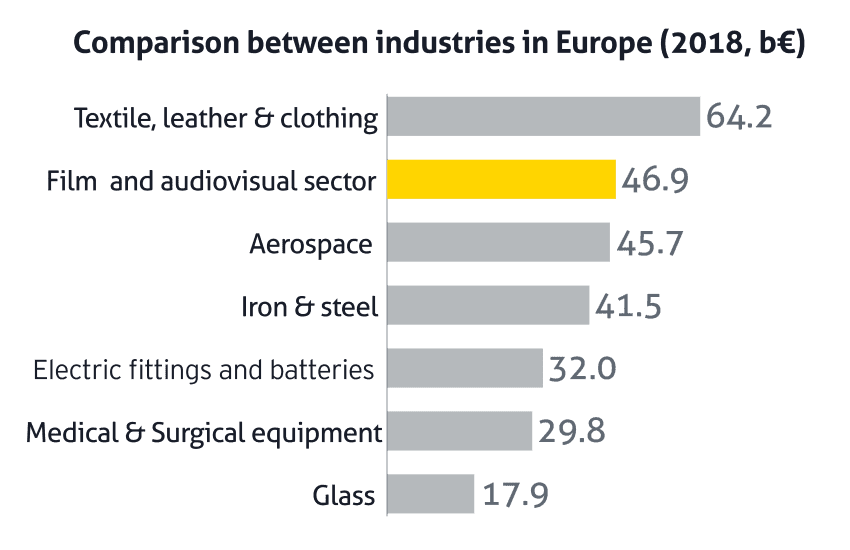

The film and audiovisual sector in Europe contributes €46.9 Billion to the European GDP, and generates more added value than the aerospace sector (€45.7b) and iron & steel industry (€41.5b).

EMPLOYMENT

The film and audiovisual sector directly employs more than 1 million people across Europe.

This accounts for 1,049,000 jobs in direct employment in 2018. Previous to COVID-19, employment grew quicker than turnover, highlighting the high-job concentration of the industry: between 2013 and 2018, 218,500 jobs were created over 5 years, representing a growth of 5.1% (vs. 2% per year for turnover).

Indirect and induced employment provides another estimated 1,000,000 jobs in 2018 throughout Europe. Film and Audiovisual businesses are deeply integrated into a network of technical partners and subcontractors (security, sound systems, textiles…).

Based on the UK and other countries’ multipliers, there are at least as many indirect or induced jobs as people directly employed. While there is no robust employment data available for freelancers, professional organizations confirm that they represent an important part of industry direct employment.

AN SME-HEAVY SECTOR

The European film and audiovisual sector is dominated by small and medium enterprises (SMEs), with 77.6% of businesses structured around 0-to-1 employees.

The film and audiovisual sector represented more businesses in Europe than the telecommunications sector (49,000) in 2018.

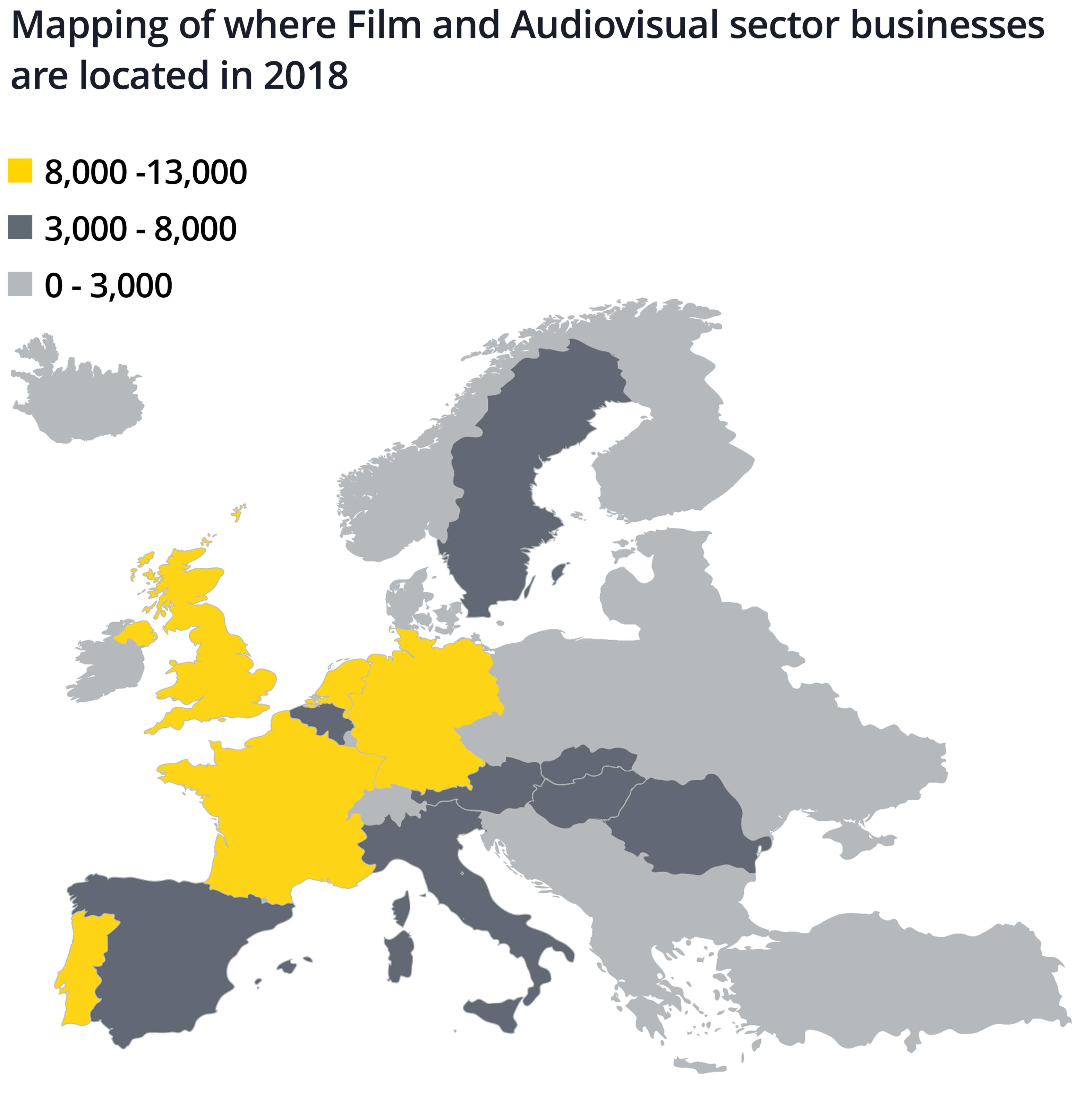

The Netherlands (12,100), the UK (12,023), France (11,487) are the three most significant countries in terms of film and audiovisual businesses in 2018. Eastern European and Nordic countries, however, are also key players in the number of businesses across Europe: Poland (7,394), Sweden (8,552), Norway (2,877), Romania (2,518) in 2018.

EXPORTS

Within the overall film and audiovisual sector, film is a springboard for European exports.

Films exported outside of Europe provided €5.1 Billion in revenue in 2018, thus representing a 19% increase in turnover growth between 2013 and 2018.

Exports are growing and are becoming more important to the European film and AV sector’s economic model, and now account for 4.2% of the film and audiovisual turnover (up from 3.8% in 2013).

France (€0.4b), Germany (€0.7b) and the UK (€1.9b), are the main film exporters in Europe. Iceland, Estonia and the UK are the countries most dependent on exports, accounting for 9.1%, 8.1% and 8%, respectively of their local turnover.

Film exports represent 18% of European Cultural and Creative exports (as defined by Eurostat: works of art, books, recorded media, jewelry and antiques).

SPORTS

As important actors in the sports industry, TV channels and broadcasters enhance the positive economic impact that sports have on the economy:

- €27b in direct economic impact (in turnover)

- More than 280,000 direct jobs

- €10b in fiscal contributions for France, Spain, the UK, Italy and Germany.

With €13.6b paid by broadcasters on a territory-by-territory basis in exchange for access to sports contents, TV rights represent a massive part of sports business revenues in Europe. TV rights are now the most significant share of sports bodies’ revenues (more than 80%).

It is this territory-by-territory rights exchange that replaces the high costs of investment into the production of sporting events, competitions and trainings, away from placing the burden of higher costs to the consumer, while providing a more varied viewing experience of sporting options.